Finance

For most people, buying a car can be the second biggest purchase they ever make. With so many vehicle finance options available on the market, understanding the products and what works best for your budget can be confusing, particularly in the current financial climate, where obtaining flexible and competitive terms is more important than ever.

Personal Contract Purchase (PCP)

"The most flexible and popular way to finance a car, giving you the opportunity to own more car, more often, and providing a guarantee for your vehicle value at the end of the contract. Available with small or zero deposit."

How does it work?

- Select the car that's best for you - new or used up to 5 years old. Many new cars attract support from the manufacturer, meaning low interest or in many cases, 0% options available.

- Tell us your approximate annual mileage - up to 30,000 miles per annum.

- Based on this information we will set a Guaranteed Future Value (GFV) for your car - this is the minimum amount your car will be worth at the end of the contract.

- Choose the term that suits you best - 24, 30 or 36 months. The amount financed is lower than traditional finance methods as your deposit, plus the GFV, are subtracted from the price of the car. The remaining balance is the amount financed, plus interest if applicable.

- At the end of your agreement you then have 3 simple, flexible choices:

- Part exchange and start again with another new car - any amount left over above the guaranteed value can be used as a deposit on your next vehicle

- Hand the car back in with no further payment to make, assuming it is within the agreed mileage and is in a 'fair wear and tear' condition

- Make the final payment and keep the car for longer - we are also able to re-finance your final payment if required

Would it suit me?

- Low or nil deposit

- Fixed interest rates

- Reduced monthly payments compared to traditional finance methods

- Mileage up to 30k per annum

- Like to change car every 3 years or less

Hire Purchase (HP)

"The traditional way to finance your car - fixed monthly payments, up to 5 year term and low or high deposit levels. At the end of the agreement you own the car outright, assuming you have made all payments to the finance company on time."

How does it work?

- Select the car that's best for you

- Pay a deposit, usually from 10% to a maximum of 85%

- Agree a term for the balance, from 12 months to a maximum of 60 months (5 years)*

- This balance, plus interest if applicable, is the amount financed

- Make regular monthly payments and at the end of the contract, once the final payment has been made, the car is yours to keep

Would it suit me?

- Low or high deposit contribution

- Flexible terms - up to 5 years

- Longer term car retention

- Fixed interest rates

What is Business Contract Hire?

Business contract hire is a long-term lease agreement which allows a business to pay a fixed monthly rental cost for the use of a vehicle. The leasing provider will be the owner of the car while you have it, and at the end of the agreement you’ll give the car back* - meaning you won’t need to worry about depreciation or disposing of it.

Business contract hire is one of the most popular ways for VAT registered companies to drive a car, as you could claim back up to 50% of the VAT** on the cost of renting, which means you’ll save money overall. It works in a similar way to personal contract hire, but it’s exclusively for companies, and has the added VAT benefits.

*No ownership option. Return conditions and excess mileage charges apply

** Subject to VAT status and usage of the vehicle. Consult your tax advisor if unsure how this applies to your business.

WHAT ARE THE BENEFITS OF BUSINESS CONTRACT HIRE?

One of the main benefits of business contract hire is that VAT registered companies could claim back up to 50% of the VAT, making it an affordable, cost-effective way of driving a company car.

We know that budget planning has an important part to play in any business, and the fixed monthly rentals help to make this easier. We even offer an extra option to include maintenance costs at the start of the contract - this means you’ll be able to spread the cost of maintaining your company cars across the year and if you do run into any problems you can be sure that you’ll be back on the road as quickly as possible.

Also, the fact that you give the car back to us at the end of the agreement means that you can go straight into another car leasing contract subject to status and a new credit application to get the latest car, so your fleet will be up to date with the most recent model.

Contract hire agreements are flexible, so you can choose a plan which suits you and your business - with options on different agreement lengths as well as flexible upfront costs and mileage limits.

HOW MUCH ARE MONTHLY RENTALS?

The amount you pay each month for your business contract hire can vary depending on the options you choose for your business. Your rentals are calculated based on:

- The cost of the model and grade which you decide to go for

- The duration of the contract: our contracts can be between 24 and 60 months in length

- The amount of the initial rental you decide to pay up front (equivalent of between 1 to 12 months normal monthly rental)

- Your annual mileage allowance, which you can choose at the start of your contract (minimum 5,000 to maximum 25,000)

- Whether you decide to go with our maintenance option***. This covers costs of routine servicing, tyres, replacement parts and repairs due to wear and tear

***Business Contract Hire (or Contract Hire) is available to business users only, subject to status and credit application. Contract Hire is provided by Lex Autolease Limited trading as Suzuki Contract Hire, Heathside Park, Heathside Park Road, Stockport SK3 0RB. No ownership option, return conditions and excess mileage charges apply

WHAT HAPPENS AT THE END OF THE CONTRACT?

At the end of your contract, you’ll return the car to us. You’re then free to start another business contract with us for one of the latest models. If you’ve gone over the agreed total contracted mileage, then an extra charge is worked out on a pence per mile basis - this will be outlined to you at the start of your agreement.

There can sometimes also be charges if there is damage to the vehicle which falls outside of ‘fair wear and tear’ in accordance with the British Vehicle Rental and Leasing Association guide.

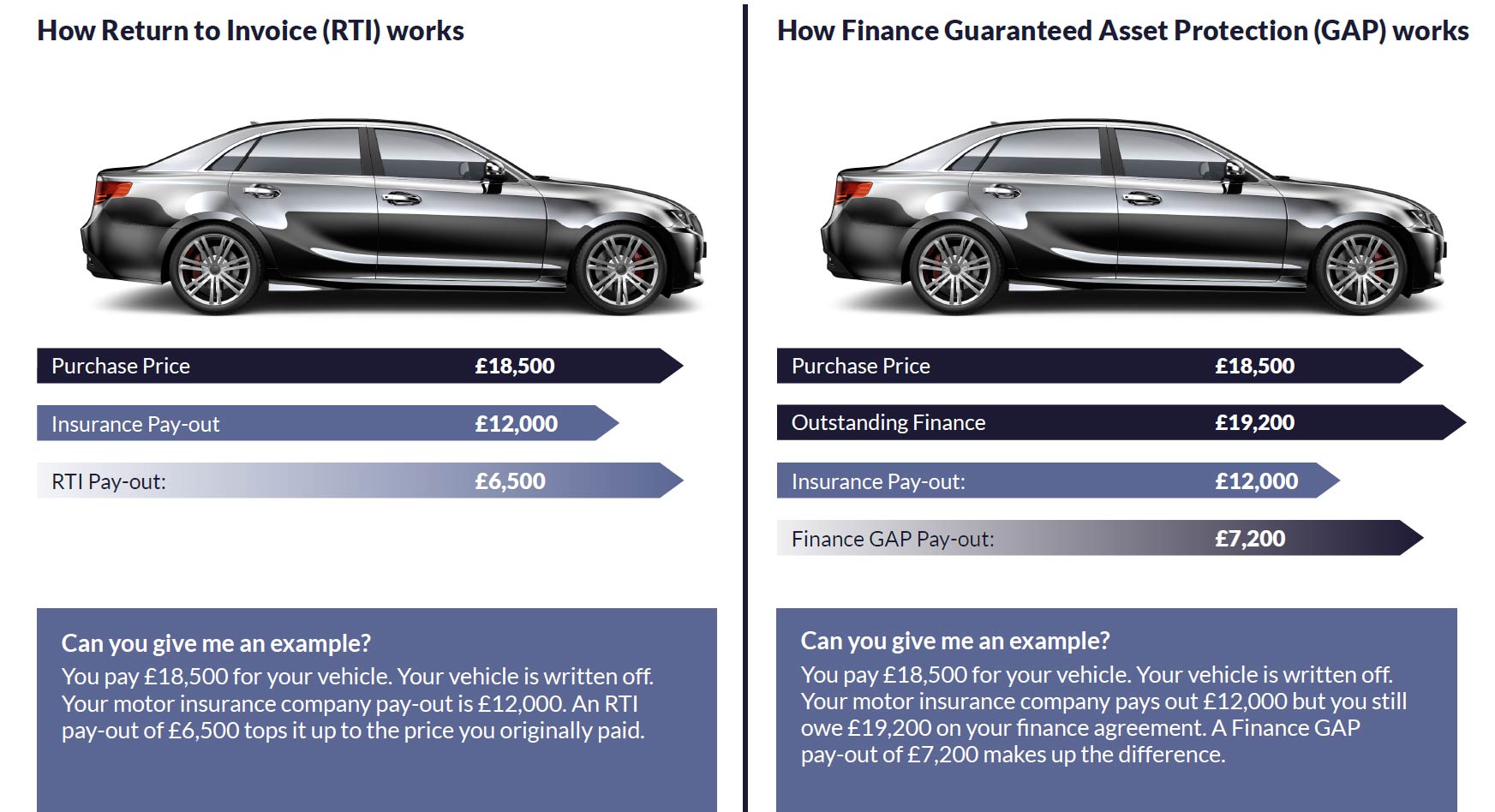

HOW ASSET PROTECTION WORKS

Asset Protection incorporates Return to Invoice cover (or RTI) and Finance Guaranteed Asset Protection (or Finance GAP).

RTI is designed to pay-out any difference between the settlement made by your motor insurance company and the price you originally paid for the vehicle.

If your vehicle is written off, Finance GAP pays the difference between the settlement made by your motor insurance company and the amount you still owe on your finance agreement.

Asset Protection covers you however you paid for the vehicle and will pay-out the greater of the Finance GAP or RTI amount, up to the purchase price of the vehicle. However, there are specific exclusions (please see following page).

Asset Protection is an OPTIONAL facility available from this dealership. Our sales consultants will be happy to answer your questions or clarify the policy benefits and exclusions. You should be aware that similar products may be available elsewhere to purchase directly. However, as with any WATCH ME insurance policy, you should confirm that the cover levels of alternative facilities are suitable for your needs.

Smart Protect

WHAT IF... the bodywork on your shiny new car gets chipped, dented, scuffed or scratched? Let’s face it, everyday wear and tear like this is hard to avoid, no matter how careful you are. Best to invest in SMART Protect from AutoProtect.

SIGNIFICANT BENEFITS... As the name suggests, SMART Protect is a policy designed to help you keep your car in perfect condition, without compromising your no claims bonus. So your vehicle’s bodywork will remain in great condition, and when you come to sell it – should you ever wish to – its resale value is maintained.

HOW SMART PROTECT WORKS... Contact our Customer Service team to validate your claim and arrange for one of our expert repair technicians to come to you at home or work at a time that suits. The best way to submit your claim is via our SMART app but if you prefer you can go online or give us a call.

TRUSTED EXPERTS... With the repairer’s state-of-the-art bodywork repair technology, chips, dents, scuffs or light scratches can be erased on the spot*. All work is guaranteed for as long as you own the vehicle, and our streamlined claims-handling procedure is the best in the business.

REAL PEACE OF MIND... SMART Protect from AutoProtect is designed to help you keep your car in tip-top condition. Your sales consultant can tell you all you need to know about the product and the company that provides it. So please don’t hesitate to ask.

Should any claim not qualify as a SMART repair, or an invisible result cannot be achieved, up to a £250 contribution will be paid towards a body-shop repair (upon receipt of a valid invoice).

-

Helps to keep cars looking new

Chips, dents, scuffs and light scratches are covered with SMART Protect. -

No claims protection

Making a claim does not affect no claims bonuses. -

The easy way to claim

Once you have a live policy, if you need to make a claim you can via our SMART app, online or on the phone.† -

Nationwide coverage

We come to you, at home or at work, at your convenience. -

The best SMART repair

Our SMART repair service sets the industry standard. There is none better.

* Exclusions: This policy does not cover panel replacement, stickers and decals, beading and mouldings, cracked or dented bumpers or their replacement. Repairs will only be undertaken if an invisible result can be achieved using SMART technology, bodyshop repairs are excluded. Third party liability is excluded.

† This facility is only available to customers that hold live SMART policies.

Complete Wheel Insurance

with Contribution

Keeps your car in showroom condition with cover for your tyres and alloy wheels

What is Complete Wheel Insurance?

Complete Wheel Insurance is designed to maintain the appearance of the wheels on your car by giving you easy access to repairs for annoying scuffs, scrapes or punctures that occur as a result of everyday driving. When you come to sell your car, you won't lose out on your part-exchange valuation because of the damage to your wheels.

What is covered?

If your claim is successful, we will pay towards the cost of a repair or replacement to your tyres or alloys, up to the claim limits detailed in your policy schedule. All you need to do is arrange and pay for a repair or replacement, and we'll reimburse the cost.

How do I make a claim?

Claims on our Complete Wheel policies are handled through the AutoProtect App. Simply download the App, input your details and upload photos of the damage and we'll get back to you within minutes with a decision on on how your claim will be processed.

What are the benefits?

- We pay a contribution to repairs of tyres or alloy wheels should they become damaged.

- We pay a contribution to a replacement of tyres or alloy wheels if a repair is not possible.

- We cover manufacturer-fitted aerodynamic wheels, diamond cut and laser cut finishes.

- We'll cover up to five tyre and five alloy wheel claims during the period of insurance.

- Simple and easy to use claims with our award-winning App.

How to get started

Speak to us today to discuss getting Complete Wheel Insurance for your car.

Significant Exclusions

This policy doesn't cover general wear and tear, vehicles over 7 years and/or 100,000 miles, non-UK residency, wheels over 23 inches, theft, damage whilst carrying out general maintenance including tyre changing or where the cost of a repair for a wheel or replacement is recoverable under any other insurance. See full terms and conditions.

Scan this QR code to view our Complete Wheel video

Car finance: here to help you

Do you have historic credit issues and are concerned that you may not be able to get car finance? Don’t worry, we have a prearranged car finance facility that has been designed to help those who may have had poor credit in the past, to purchase a car at an affordable monthly rate. We have access to a wide range of lenders who can tailor a finance offer to try and suit your individual needs. Our provider is Mann Island, 5 St Paul's Square, Liverpool L3 9SJ telephone: 0370 600 6668. They offer numerous finance products but especially have PCP products for used cars, helping to make cars more affordable.

How do we do this?

We discuss how much you can afford every month with us and understand your credit history. This information is then passed to a number of lenders who match your needs to their criteria. You will then be informed when suitable lender makes an offer.

What benefits does this offer?

The service means that you may not have to make several credit applications which may affect your credit rating further. It may save you time trying to find an offer which you can afford. The service is free with no obligation quotes.

What exclusions are there?

However, the service may not be able to find an offer which is suitable for your circumstances and it may be that an offer made may have a longer duration than your preferred choice.

Can anyone apply?

If you are over the age of 18 years, with a full UK driving licence, who has been resident in the UK for 3 years and is employed or self-employed can apply. All finance is subject to terms and conditions and eligibility criteria, the rate you receive will be individual to your circumstances. Please contact us for more information.

Where can I find out more?

If you would like to take advantage of it, please email us at contact@ashfordorbital.co.uk or telephone 01233 504500 to make an appointment.